I had a few errands to run today. I had to drop off some library books, do some banking, and buy a few grocery staples that we forgot on our weekly stock up. Everything we needed to do was do-able within 3 miles of our house, making it the ideal bike errand day, and the weather was pretty good - so we broke out the bakfiets and trail-a-bike.

It's been a while since we've done a bike errand run, and even longer since I had Daniel do any of the pedaling. Daniel started to moan about the effort, and asked why we couldn't have just used the car. I told him there were two reasons we were biking - one, for the exercise and thrift/environmental benefits, and two, because it makes a boring day of errands into an adventure!

For example, today we stopped at a playground, discovered a new Little Free Library, dropped in a community center, and found a few "treasures" (a piece of bamboo, other 9 year old boy-type trinkets). I pointed out that none of that would have happened if we had gone by car, and he agreed!

Tomorrow we have to go to a homeschool PE class that's too far away to bike, so I'm really glad we took advantage of the weather and errands today.

Even though my legs feel like rubber....

Monday, March 30, 2015

Thursday, March 26, 2015

"Spring".

It's supposed to be spring. I did actually see some of my perennials coming up the other day, so maybe the calendar isn't a lying piece of crap, but the chill is bumming me out.

The other thing about spring here is it sets off 2 1/2 weeks of birthdays. First Caties', then my brothers', then Jakes', then my moms'. And Easter falls somewhere in the midst of all of this. As you can imagine, this leads to a LOT of birthday cake, gift pondering, and general preparations.

So if you don't see too much of me over the next few weeks, I promise I'm not gone for good. I'm just trying to keep up!

The other thing about spring here is it sets off 2 1/2 weeks of birthdays. First Caties', then my brothers', then Jakes', then my moms'. And Easter falls somewhere in the midst of all of this. As you can imagine, this leads to a LOT of birthday cake, gift pondering, and general preparations.

So if you don't see too much of me over the next few weeks, I promise I'm not gone for good. I'm just trying to keep up!

|

| Me, dealing. |

Wednesday, March 25, 2015

Lady stuff that saves you bucks

I started planning this post before the layoff/job finding, and in the general chaos I forgot about it until today!

DivaCup. Lunette. Skoon. Mooncup.

No, it's not a word association game - these are all brands of menstrual cups! In case you haven't heard of them yet, a menstrual cup is a flexible silicone or rubber cup, worn INSIDE the vagina. It collects the flow for up to 12 hours, then you empty it, rinse or wipe, and reinsert it.

I have a DivaCup, and I have to say I will NEVER willingly go back to tampons or pads - it's so comfortable and never leaks for me! (Every body is different, and some cups will fit some people better than others, so don't be discouraged if you try a cup and you don't like it - there is one that will work for you, especially from Skoon!)

I held off on ordering one of these for years, because 1) they cost between $30 and $40 on average, though they can last over 10 years, and 2) I was afraid I wouldn't be able to insert it properly.

There is a learning curve involved with a cup, much like the first time or two that you inserted a tampon, and it does require getting up close and personal with your... uh... person, but once you get the hang of it you'll want to tell all your friends!

DivaCup. Lunette. Skoon. Mooncup.

No, it's not a word association game - these are all brands of menstrual cups! In case you haven't heard of them yet, a menstrual cup is a flexible silicone or rubber cup, worn INSIDE the vagina. It collects the flow for up to 12 hours, then you empty it, rinse or wipe, and reinsert it.

I have a DivaCup, and I have to say I will NEVER willingly go back to tampons or pads - it's so comfortable and never leaks for me! (Every body is different, and some cups will fit some people better than others, so don't be discouraged if you try a cup and you don't like it - there is one that will work for you, especially from Skoon!)

I held off on ordering one of these for years, because 1) they cost between $30 and $40 on average, though they can last over 10 years, and 2) I was afraid I wouldn't be able to insert it properly.

There is a learning curve involved with a cup, much like the first time or two that you inserted a tampon, and it does require getting up close and personal with your... uh... person, but once you get the hang of it you'll want to tell all your friends!

Monday, March 23, 2015

Shopping from the pantry

I was baking some gluten-free goodies this week, and I used up my Xanthan Gum (something that helps gluten-free baked goods hold together). But at the worst possible time! Because I was planning to make my famous pizza that night, and my crust falls apart without xanthan gum.

I was bummed, because that meant an impromptu store trip, and extra money spent when I really didn't want to spend extra cash. But we did need it, so I went to Jake to ask him to watch the kids while I ran to the store for xanthan gum, and he said "Don't we have some in our long-term food storage?".

YES! The long term food storage! And that xanthan gum costs less to replace than the brand at the store - but of course, this is already bought and paid for, so that makes it the cheapest of all. So I dug out the xanthan gum, and pizza night was saved!

I was bummed, because that meant an impromptu store trip, and extra money spent when I really didn't want to spend extra cash. But we did need it, so I went to Jake to ask him to watch the kids while I ran to the store for xanthan gum, and he said "Don't we have some in our long-term food storage?".

YES! The long term food storage! And that xanthan gum costs less to replace than the brand at the store - but of course, this is already bought and paid for, so that makes it the cheapest of all. So I dug out the xanthan gum, and pizza night was saved!

Thursday, March 19, 2015

Whoo hooo!!!!!

Great news, everyone! Jake has a job! Thank you for all your prayers - we're so grateful.

Details - he'll be back to working construction - he's been doing maintenance electrical work for the last two years, and found it dull. He likes construction better - it's more physical, but also more creative. His pay will be slightly lower for the first three months, but after that should match his previous salary. They're even talking about grooming him to run small crews as a team leader/foreman!

We won't have to file unemployment, since he's only been off a week. Ditto all the other programs we won't have to file with, which is a load off - I hate all that paperwork.

This is such a boost for Jake - he was starting to feel pretty low with this layoff. When he used to be laid off with the union, he wasn't allowed to look for non-union work unless he wanted to get off the work list, and that was unnerving. He knew he would eventually get work with the union - it might take a long time, but it was a sure thing. When he got the last job, it technically didn't conflict with the union, since the union only handles construction - not maintenance. So he did an "honorable withdrawal" of his union card, which allowed him to look for non-union work unless he wanted to pay dues and rejoin - I'm SO glad now that he didn't try to rejoin! He now knows he can get work in his field all on his own, no union needed, and he'll be part of a real team environment instead of being an interchangeable electrician on a list.

So, payoff plans are still in place for our debts, but we're not feeling as desperate as we were a week ago. Our plan (because we didn't do it yet) to use our savings to eliminate our credit card is on hold, since Jake wants to use that money for the construction of the new bedroom. We'll keep up the frugal activities, just as a security measure - I don't feel safe with all this debt hanging over our heads, and won't feel totally safe until it's much lower or gone.

But the scariest part is over, thanks be to God!

Details - he'll be back to working construction - he's been doing maintenance electrical work for the last two years, and found it dull. He likes construction better - it's more physical, but also more creative. His pay will be slightly lower for the first three months, but after that should match his previous salary. They're even talking about grooming him to run small crews as a team leader/foreman!

We won't have to file unemployment, since he's only been off a week. Ditto all the other programs we won't have to file with, which is a load off - I hate all that paperwork.

This is such a boost for Jake - he was starting to feel pretty low with this layoff. When he used to be laid off with the union, he wasn't allowed to look for non-union work unless he wanted to get off the work list, and that was unnerving. He knew he would eventually get work with the union - it might take a long time, but it was a sure thing. When he got the last job, it technically didn't conflict with the union, since the union only handles construction - not maintenance. So he did an "honorable withdrawal" of his union card, which allowed him to look for non-union work unless he wanted to pay dues and rejoin - I'm SO glad now that he didn't try to rejoin! He now knows he can get work in his field all on his own, no union needed, and he'll be part of a real team environment instead of being an interchangeable electrician on a list.

So, payoff plans are still in place for our debts, but we're not feeling as desperate as we were a week ago. Our plan (because we didn't do it yet) to use our savings to eliminate our credit card is on hold, since Jake wants to use that money for the construction of the new bedroom. We'll keep up the frugal activities, just as a security measure - I don't feel safe with all this debt hanging over our heads, and won't feel totally safe until it's much lower or gone.

But the scariest part is over, thanks be to God!

Saturday, March 14, 2015

Getting our act together

Like I said before, a lot of our more frugal actions have fallen by the wayside (and new debt was incurred!) because we had been lulled into a false sense of security, thinking that Jake's job was a given.

To give some background, for many years, Jake worked for the electrician union. In our area, that meant sitting on a waiting list for 6 - 7 months out of the year, using unemployment benefits, and 5 - 6 months of work at a good rate of pay. We kept our bills at a level that we could afford even in the lean months, and paid extra on debts in the good times. We had action steps for layoffs, knowing what things we would need to apply for and what things we would have to avoid until a job would come up.

Jake hasn't been laid off since Tristan was born, and back then both Catie and Daniel were in public school, so I was able to do more side work back then. If this span of unemployment goes on for a while, I'll look for work and let Jake take over the child watching/homeschooling duties for a while. Since we use allinonehomeschool.com , the homeschooling duties mostly involve checking his work and making sure he understands the assignments.

Things that we did immediately to reduce our costs -

Lowered our thermostat to 66 (formerly 68) and are wrapping up and using our woodstove more.

Have gotten more vigilant about turning off lights (me).

Dried a load of laundry on a rack by the fire.

Called AT&T and lowered our bill $40 a month just by asking.

Asked Comcast for a better plan, but got shot down. We're in a promotional deal right now, so every other deal would cost us more.

Took a chunk of our savings (meant for building supplies for the new bedroom) and used it to eliminate a bill - the same credit card I was paying down with my side money. That will leave us with 2 car loans (about 12K total), an interest-free debt for some furniture, and some small medical bills from my recent medical testing. I'll keep using half of my side money to pay things down.

Technically, Jake isn't even unemployed until Monday, and he has 20+ resumes submitted to various companies.

Thank you for your prayers and support!

To give some background, for many years, Jake worked for the electrician union. In our area, that meant sitting on a waiting list for 6 - 7 months out of the year, using unemployment benefits, and 5 - 6 months of work at a good rate of pay. We kept our bills at a level that we could afford even in the lean months, and paid extra on debts in the good times. We had action steps for layoffs, knowing what things we would need to apply for and what things we would have to avoid until a job would come up.

Jake hasn't been laid off since Tristan was born, and back then both Catie and Daniel were in public school, so I was able to do more side work back then. If this span of unemployment goes on for a while, I'll look for work and let Jake take over the child watching/homeschooling duties for a while. Since we use allinonehomeschool.com , the homeschooling duties mostly involve checking his work and making sure he understands the assignments.

Things that we did immediately to reduce our costs -

Lowered our thermostat to 66 (formerly 68) and are wrapping up and using our woodstove more.

Have gotten more vigilant about turning off lights (me).

Dried a load of laundry on a rack by the fire.

Called AT&T and lowered our bill $40 a month just by asking.

Asked Comcast for a better plan, but got shot down. We're in a promotional deal right now, so every other deal would cost us more.

Took a chunk of our savings (meant for building supplies for the new bedroom) and used it to eliminate a bill - the same credit card I was paying down with my side money. That will leave us with 2 car loans (about 12K total), an interest-free debt for some furniture, and some small medical bills from my recent medical testing. I'll keep using half of my side money to pay things down.

Technically, Jake isn't even unemployed until Monday, and he has 20+ resumes submitted to various companies.

Thank you for your prayers and support!

Wednesday, March 11, 2015

Things just got real.

I've been feeling very relaxed about money for a while now. Jake has had a steady job for two years, I make a little side money with my book sales, etc, and while we're not exactly rolling in dough, we've been able to put aside some savings and make a few purchases. Unfortunately, two of those purchases (the new van and some furniture) were financed, but we figured with the current income level we could focus, get them paid off, and be back to debt free in a few years.

I really wish we had paid cash right now.

Jake's job is with a civilian contractor for a military base - he's a maintenance electrician. Every two years or so, the contract comes up for review, to see if the government wants to keep the company or find a new one. A few days ago, we heard that the contract was renewed! We breathed a sigh of relief ' the only thing was they were going to pay out any vacation benefits to all employees, then let them start accruing time again after a certain date.

Today Jake's boss got another email - cut one of the day guys. Jake is only an electrician - he has no other "official" skills, such as HVAC - so he was told he's getting laid off as of this week. (Edited - several other people from other shifts were also laid off, not just Jake.)

Thank goodness, he'll qualify for unemployment, and he's getting all his vacation time paid out. He still has his card open with the Union, so the first thing he'll do is sign up to get on the work list. The trouble is the list is long, and work is slow.

So we're going to have to get back to all the frugal things that we know how to do, and probably should have been doing all along, but let slide. Because it just got really real around here.

Step one - I've been saving half of my earnings (using the other half on our credit card to pay it down faster) to put an electric assist kit on my bike. I have enough as of today to order it and have it put on, but I'm going to pray before I go and buy it. Because my thought has been that if I use the trike (with e-assist) most of the summer, I can keep from running the van as much. The new van does get better mileage than the old van, but using no gas is better than some gas. Still, I can PEDAL the trike a lot of places, so I'm very conflicted - would the money be better spent on bills?

Step two - whether I buy the e-assist or not, ALL future side earnings will go to paying off the debt. And with Jake spending more time at home, I'll have a little more leeway to schedule massages for clients I haven't seen in a while. Me getting a "real" job is probably not feasible, considering my low income potential and figuring out how to manage Daniel's school and Tristan's care.

Step three - Oh crap, we may have to reapply for insurance for the kids! They currently have CHIP, but when he's on unemployment we actually earn TOO LITTLE for CHIP. So they may have to go back on Medicaid, which I despise, but it's better than losing the house over a doctor bill. And with that said, we may also qualify for other aid - food stamps, very likely. Ugh. I thought I'd never have to go through that again. I really don't want to go back to food stamps, but I'm not too proud to feed my family with them. If we need them, we'll use them.

Step 4 - We were beginning the application process for a scholarship for Catie's school next year. We'd definitely qualify (we did even before) but this complicates the application process - we don't KNOW what the income will be next year! So what can we tell them? But this is a non-negotiable thing for me - Catie WILL keep going to Catholic school next year. The only thing that could change that would be if there were no help of any kind in paying, and the grandparents have helped this year and offered to help next year if needed.

Step 5 - I had already paid for an upcoming 6 week phys. ed. course for Daniel ($40), but after that he really wanted to start Tae Kwon Do. Unfortunately, that's going to be postponed. It would have been a stretch before, anyway. Catie dropped Irish dance a few months ago, so nothing to cut there.

Step 6 - really, this step is continuous and included in all the others - pray. We'll pray that Jake finds another job, pray that my book sells, pray that we both can earn money in the meantime, and pray for mental and spiritual peace. Things could get a little bumpy.

I really wish we had paid cash right now.

Jake's job is with a civilian contractor for a military base - he's a maintenance electrician. Every two years or so, the contract comes up for review, to see if the government wants to keep the company or find a new one. A few days ago, we heard that the contract was renewed! We breathed a sigh of relief ' the only thing was they were going to pay out any vacation benefits to all employees, then let them start accruing time again after a certain date.

Today Jake's boss got another email - cut one of the day guys. Jake is only an electrician - he has no other "official" skills, such as HVAC - so he was told he's getting laid off as of this week. (Edited - several other people from other shifts were also laid off, not just Jake.)

Thank goodness, he'll qualify for unemployment, and he's getting all his vacation time paid out. He still has his card open with the Union, so the first thing he'll do is sign up to get on the work list. The trouble is the list is long, and work is slow.

| |

| My face when I heard the news. |

So we're going to have to get back to all the frugal things that we know how to do, and probably should have been doing all along, but let slide. Because it just got really real around here.

Step one - I've been saving half of my earnings (using the other half on our credit card to pay it down faster) to put an electric assist kit on my bike. I have enough as of today to order it and have it put on, but I'm going to pray before I go and buy it. Because my thought has been that if I use the trike (with e-assist) most of the summer, I can keep from running the van as much. The new van does get better mileage than the old van, but using no gas is better than some gas. Still, I can PEDAL the trike a lot of places, so I'm very conflicted - would the money be better spent on bills?

Step two - whether I buy the e-assist or not, ALL future side earnings will go to paying off the debt. And with Jake spending more time at home, I'll have a little more leeway to schedule massages for clients I haven't seen in a while. Me getting a "real" job is probably not feasible, considering my low income potential and figuring out how to manage Daniel's school and Tristan's care.

Step three - Oh crap, we may have to reapply for insurance for the kids! They currently have CHIP, but when he's on unemployment we actually earn TOO LITTLE for CHIP. So they may have to go back on Medicaid, which I despise, but it's better than losing the house over a doctor bill. And with that said, we may also qualify for other aid - food stamps, very likely. Ugh. I thought I'd never have to go through that again. I really don't want to go back to food stamps, but I'm not too proud to feed my family with them. If we need them, we'll use them.

Step 4 - We were beginning the application process for a scholarship for Catie's school next year. We'd definitely qualify (we did even before) but this complicates the application process - we don't KNOW what the income will be next year! So what can we tell them? But this is a non-negotiable thing for me - Catie WILL keep going to Catholic school next year. The only thing that could change that would be if there were no help of any kind in paying, and the grandparents have helped this year and offered to help next year if needed.

Step 5 - I had already paid for an upcoming 6 week phys. ed. course for Daniel ($40), but after that he really wanted to start Tae Kwon Do. Unfortunately, that's going to be postponed. It would have been a stretch before, anyway. Catie dropped Irish dance a few months ago, so nothing to cut there.

Step 6 - really, this step is continuous and included in all the others - pray. We'll pray that Jake finds another job, pray that my book sells, pray that we both can earn money in the meantime, and pray for mental and spiritual peace. Things could get a little bumpy.

Monday, March 9, 2015

Sun!?!?!

Oh WOW! The sun is out today, and the temps are actually above freezing! That tears it - I HAVE to get the big bike out of the shed and go for a ride today!

In other bike related talk, I've finally almost saved enough for my electric assist kit! I should be able to have it ready by the end of March, putting me in prime riding weather. Wheeeeee!

In other bike related talk, I've finally almost saved enough for my electric assist kit! I should be able to have it ready by the end of March, putting me in prime riding weather. Wheeeeee!

Friday, March 6, 2015

"Hand to Mouth" and a quibble

I just got a chance to read "Hand to Mouth - Living in Bootstrap America". I've been wanting to read it ever since I heard that Linda Tirado, author of viral blog post "Poverty Thoughts", had been offered a book deal. For those of you who may not have heard, Tirado wrote an essay a while ago, attempting to explain the thought process (or lack thereof) of financially struggling people.

I have to say, I could identify with nearly everything she said in both the essay and in her book.

I just don't agree with it.

I get the grinding exhaustion, the feeling that you're running on a treadmill that's going too fast. It can leave you feeling like hopelessness is a natural state - that making progress is a pipe dream. She says that a certain income level, it makes no real sense to save money - after all, $5 a week is only $260 over the course of a year, if you can avoid spending any. Worthless! And useless, because she was talking about saving for a nice suit to wear while networking, and she could think of a dozen other things to spend that money on in a year.

But it's not true! Saving, even when you're broke, can improve your life and help pull you out of the poverty pit - by inches, it's true, but UP! and OUT!

For example, you can save that money to buy something that will help you keep saving money and/or time in future months. Ideas like -

a portable washing machine and a few drying racks to save the time, expense, and headache of going to the laundromat

a Republic Wireless phone so you can spend as little as $10 for unlimited talk/text every month

a bike trailer to make it easier to run errands by bike, saving money on gas and getting you some fresh air (good for both kids and stuff)

a bunch of LED lightbulbs to help lower your power bill

And the savings generated from THOSE things could be put toward bills, fun, another money saving toy - what could you think of that would improve your quality of life for $260?

I have to say, I could identify with nearly everything she said in both the essay and in her book.

I just don't agree with it.

I get the grinding exhaustion, the feeling that you're running on a treadmill that's going too fast. It can leave you feeling like hopelessness is a natural state - that making progress is a pipe dream. She says that a certain income level, it makes no real sense to save money - after all, $5 a week is only $260 over the course of a year, if you can avoid spending any. Worthless! And useless, because she was talking about saving for a nice suit to wear while networking, and she could think of a dozen other things to spend that money on in a year.

But it's not true! Saving, even when you're broke, can improve your life and help pull you out of the poverty pit - by inches, it's true, but UP! and OUT!

For example, you can save that money to buy something that will help you keep saving money and/or time in future months. Ideas like -

a portable washing machine and a few drying racks to save the time, expense, and headache of going to the laundromat

a Republic Wireless phone so you can spend as little as $10 for unlimited talk/text every month

a bike trailer to make it easier to run errands by bike, saving money on gas and getting you some fresh air (good for both kids and stuff)

a bunch of LED lightbulbs to help lower your power bill

And the savings generated from THOSE things could be put toward bills, fun, another money saving toy - what could you think of that would improve your quality of life for $260?

Wednesday, March 4, 2015

Pharmacy phun

The weather is absolute crap here again. We had an ice storm yesterday, and today we could get anywhere between 1 to 8 inches of snow (none of the weather reporters can agree on how much).

This is no time to run out of your prescriptions. But that's exactly what I did - I took my last dose last night, and immediately knew I would be in for it if the roads were bad today. Usually I fill my prescriptions at Target (about 8 miles by highway) or Giant (3 miles on a busy, hilly road), but with the sky slop covering the roads, and the way people drive like it's a dry, sunny day in inch thick ice, I didn't feel safe driving either place.

Thanks to Google, I found a little mom and pop pharmacy only a mile down a flat road - in fact, I often pass it on bike rides, but I never stopped in before. I figured I could skate over there safely enough in the van, get my meds, and if I didn't like the place I didn't have to go back.

I'm going back.

The pharmacist was pleasant and helpful, he filled my script in 10 minutes flat, and it cost the same as Target. He was genuinely grateful to have a new customer, and it's so close that I can easily bike there. Frankly, Target doesn't need my business as much as they do. And switching means one less errand that HAS to be done by car - it can be a fair-weather pleasure trip by bike! In weather like this, it's not as much of a scary prospect to get there and back by car. And because it's NOT Target, we don't get sucked into buying things we don't need, just because we're there.

He didn't have any lollipops, but we won't hold that against him. :)

This is no time to run out of your prescriptions. But that's exactly what I did - I took my last dose last night, and immediately knew I would be in for it if the roads were bad today. Usually I fill my prescriptions at Target (about 8 miles by highway) or Giant (3 miles on a busy, hilly road), but with the sky slop covering the roads, and the way people drive like it's a dry, sunny day in inch thick ice, I didn't feel safe driving either place.

Thanks to Google, I found a little mom and pop pharmacy only a mile down a flat road - in fact, I often pass it on bike rides, but I never stopped in before. I figured I could skate over there safely enough in the van, get my meds, and if I didn't like the place I didn't have to go back.

I'm going back.

The pharmacist was pleasant and helpful, he filled my script in 10 minutes flat, and it cost the same as Target. He was genuinely grateful to have a new customer, and it's so close that I can easily bike there. Frankly, Target doesn't need my business as much as they do. And switching means one less errand that HAS to be done by car - it can be a fair-weather pleasure trip by bike! In weather like this, it's not as much of a scary prospect to get there and back by car. And because it's NOT Target, we don't get sucked into buying things we don't need, just because we're there.

He didn't have any lollipops, but we won't hold that against him. :)

Monday, March 2, 2015

Oh, crap!

In case you're wondering, I've found a few sure-fire cures to toddler constipation that have nothing to do with diet, laxatives, or other common remedies.

Option 1 - leave him with a sitter after running out of all the "easy" cloth diapers. Be sure all the cloth wipes are hard to find or dirty.

Option 2 - Think to yourself "He's been doing pretty great with this potty training, I think I'll just put him in underwear today". Then make sure you put him in underwear with NO side snaps or easy access.

Option 3 - Get him all nice and clean, put cute clothes on him, and don't sweat putting on a diaper with good leg elastic.

Poop will happen. Guaranteed, or your money back.

Option 1 - leave him with a sitter after running out of all the "easy" cloth diapers. Be sure all the cloth wipes are hard to find or dirty.

Option 2 - Think to yourself "He's been doing pretty great with this potty training, I think I'll just put him in underwear today". Then make sure you put him in underwear with NO side snaps or easy access.

Option 3 - Get him all nice and clean, put cute clothes on him, and don't sweat putting on a diaper with good leg elastic.

Poop will happen. Guaranteed, or your money back.

Sunday, March 1, 2015

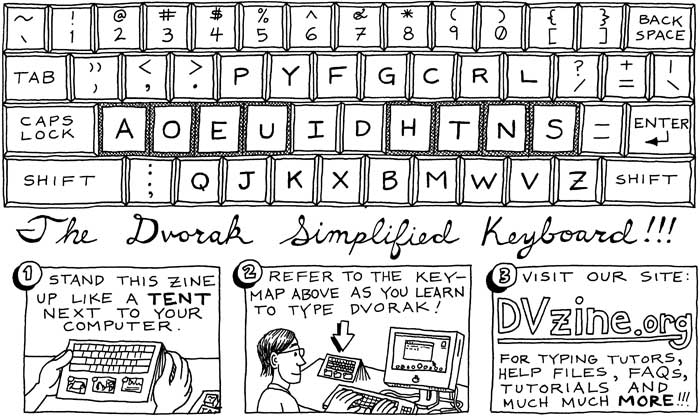

Dvorak - an experiment

As research for an upcoming article I'm pitching, I've switched the layout of my keyboard from QWERTY to Simplified Dvorak.

This is day 3. I don't think I've typed this slowly since fourth grade. My fingers, though never exactly GOOD at standard typing, are stuttering over this new layout. The worst part for a "cheater" typist like me (because I'm used to looking at my fingers) is I don't have my key relabeler stickers yet. I have to use a printed guide to help me through the sticky spots.

Maybe it's a good thing - I'm breaking a lifelong habit of staring at the keyboard. But I feel like a moron typing this way.

Any engineers or other sufficiently nerdy people ever heard of Dvorak, and the relative benefits related to typing this way? What are your thoughts? Worth learning, or waste of time?

This is day 3. I don't think I've typed this slowly since fourth grade. My fingers, though never exactly GOOD at standard typing, are stuttering over this new layout. The worst part for a "cheater" typist like me (because I'm used to looking at my fingers) is I don't have my key relabeler stickers yet. I have to use a printed guide to help me through the sticky spots.

Maybe it's a good thing - I'm breaking a lifelong habit of staring at the keyboard. But I feel like a moron typing this way.

Any engineers or other sufficiently nerdy people ever heard of Dvorak, and the relative benefits related to typing this way? What are your thoughts? Worth learning, or waste of time?

Subscribe to:

Posts (Atom)